Crushing Bitcoin Mining Profitability: The 10% Rule and How to Stay Ahead

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Crushing Bitcoin Mining Profitability: The 10% Rule and How to Stay Ahead. Let’s weave interesting information and offer fresh perspectives to the readers.

Crushing Bitcoin Mining Profitability: The 10% Rule and How to Stay Ahead

The world of cryptocurrency mining is a volatile landscape, constantly shifting with changes in market prices, network difficulty, and energy costs. For many miners, the question of profitability is a constant concern, especially in the wake of the recent bear market. However, despite the challenges, there are strategies that can help miners navigate these fluctuations and even achieve substantial returns. This article will explore the current state of Bitcoin mining profitability, focusing on a crucial concept: the 10% rule, and how miners can utilize it to maximize their chances of success.

The Shifting Sands of Profitability

Bitcoin mining, the process of verifying transactions and adding them to the blockchain, is a computationally intensive endeavor. Miners compete to solve complex mathematical problems, with the first to find the solution receiving a reward in Bitcoin. This reward, coupled with transaction fees, forms the basis of a miner’s income.

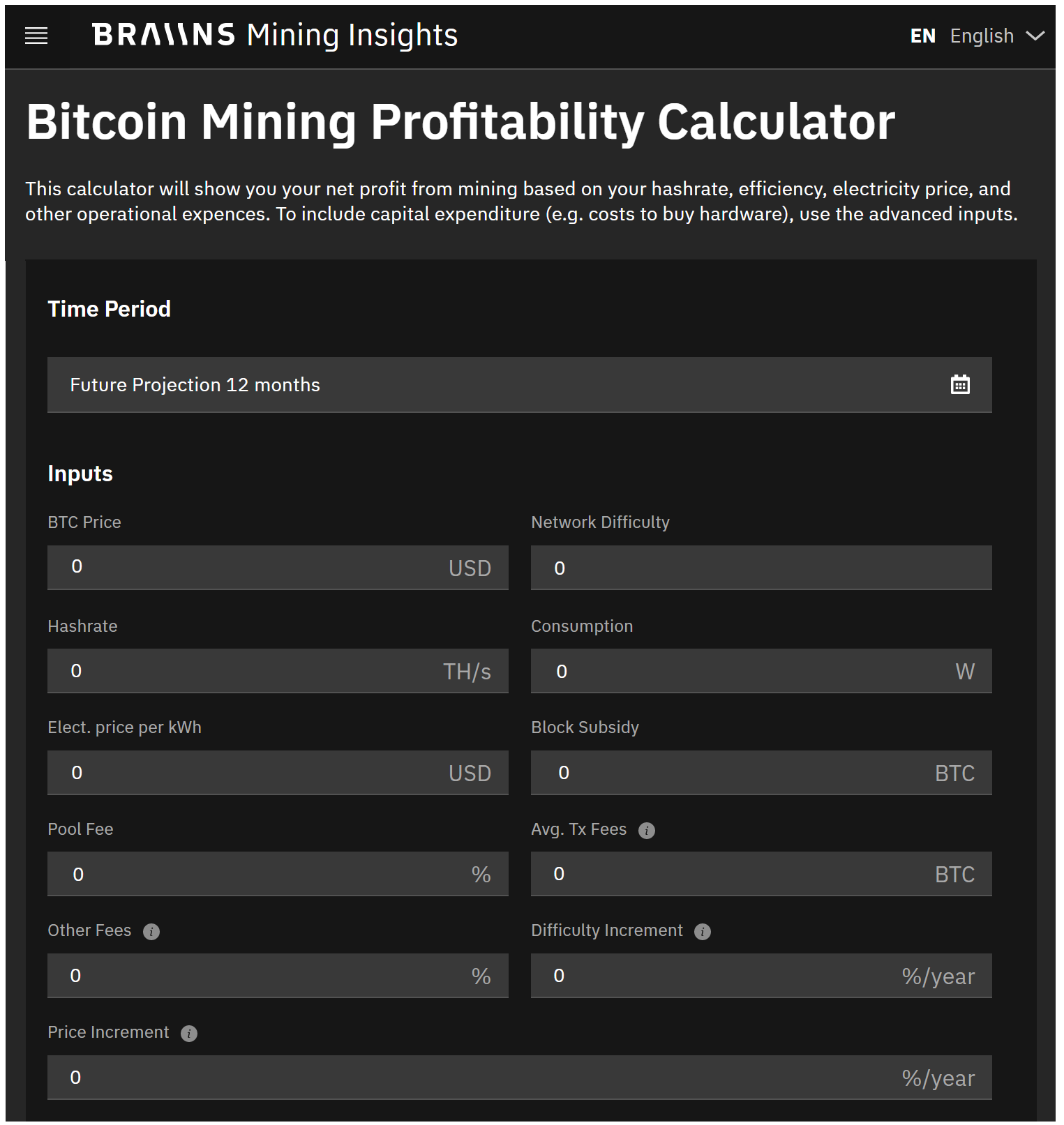

However, the profitability of Bitcoin mining is subject to several factors:

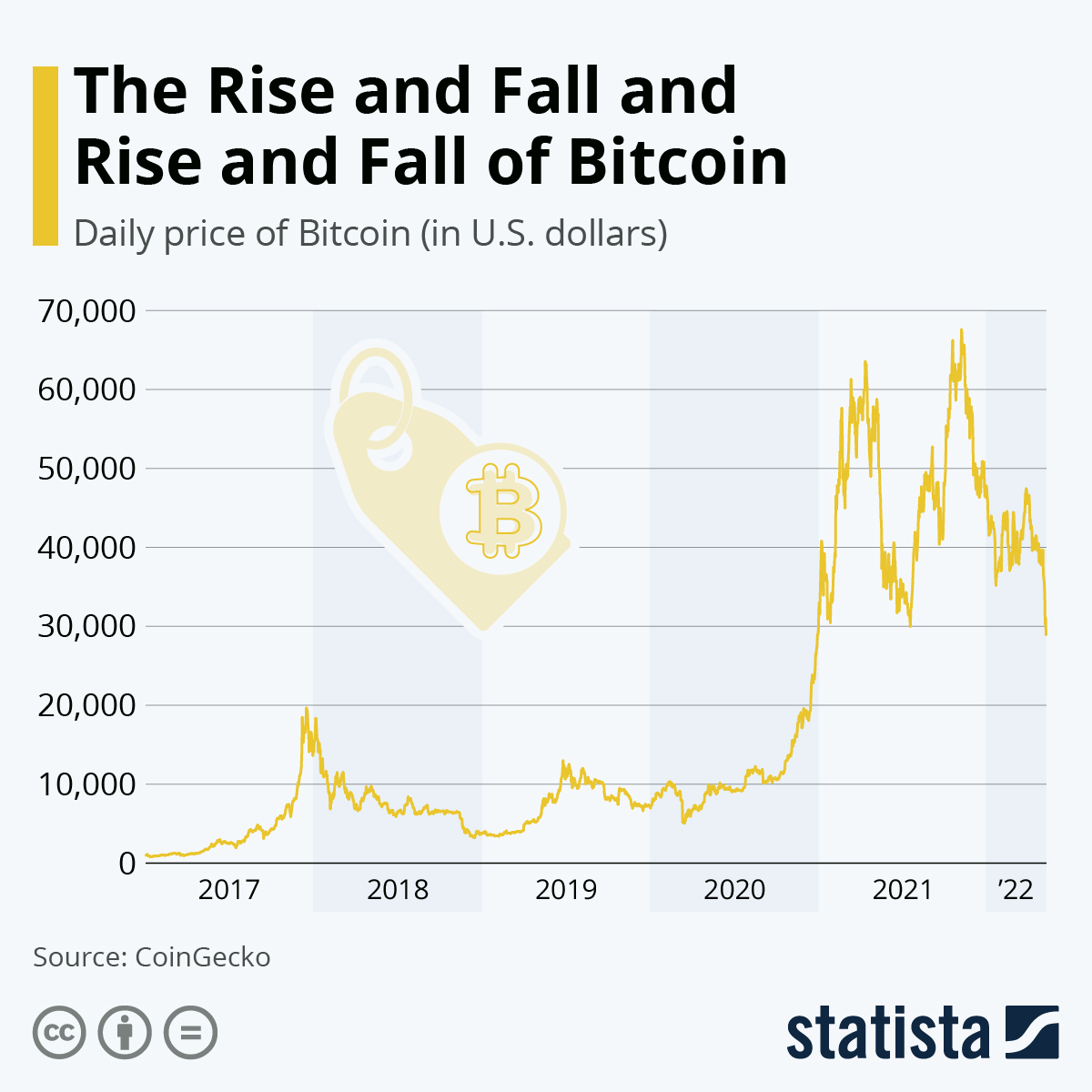

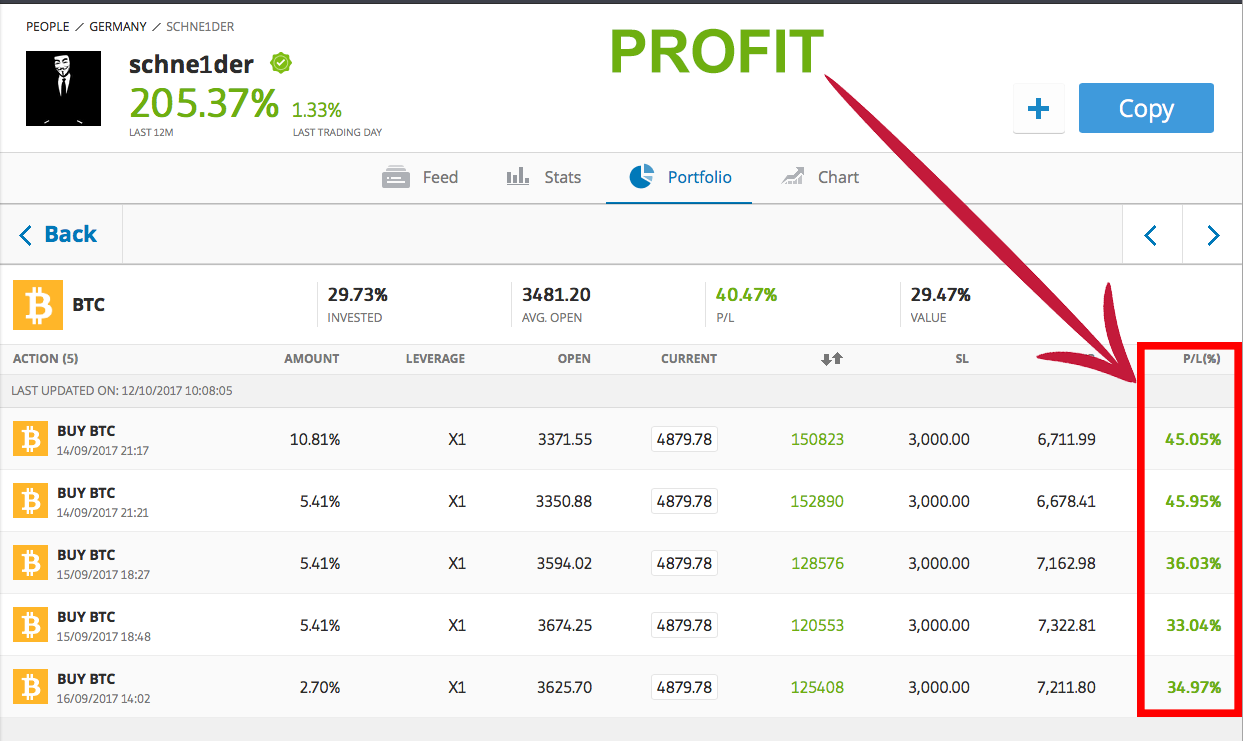

- Bitcoin Price: The price of Bitcoin directly impacts the value of the reward miners receive. A higher price means greater potential profits.

- Network Difficulty: As more miners join the network, the difficulty of solving the mathematical problems increases, making it harder to earn rewards.

- Energy Costs: Mining requires significant electricity consumption, and energy prices can vary significantly across locations.

- Hardware Costs: Mining hardware, such as ASICs (Application-Specific Integrated Circuits), are expensive investments with limited lifespans.

- Maintenance and Operating Costs: Miners must factor in the cost of cooling, maintenance, and other operational expenses.

These factors create a constantly changing landscape where profitability can fluctuate drastically. A recent example is the decline in Bitcoin’s price in 2022, which significantly impacted mining profitability.

The 10% Rule: A Guiding Principle

The 10% rule is a simple yet effective principle for navigating the volatile world of Bitcoin mining. It states that miners should aim to achieve a 10% return on their investment (ROI) per year to ensure long-term profitability. This rule acts as a benchmark, helping miners assess the viability of their operations and make informed decisions.

How the 10% Rule Works

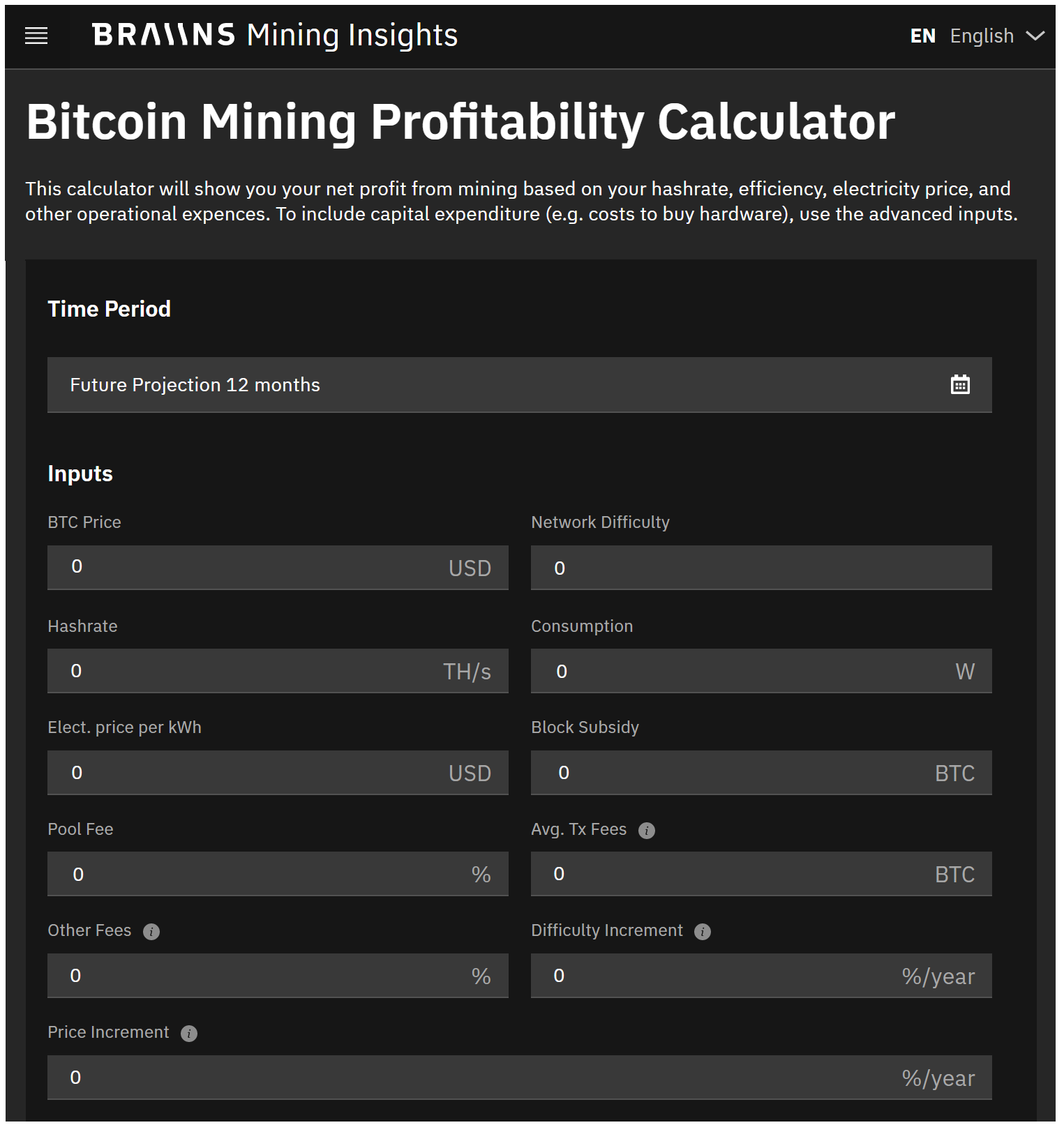

Let’s consider an example:

- A miner invests $10,000 in mining hardware.

- The 10% rule dictates that the miner should aim to earn $1,000 per year in profits.

- To achieve this, the miner needs to generate enough Bitcoin to cover their operating costs (electricity, maintenance, etc.) and yield a net profit of $1,000.

Factors Affecting the 10% Rule:

- Hardware Efficiency: More efficient mining hardware consumes less electricity, leading to lower operating costs and potentially higher profits.

- Energy Costs: Regions with lower energy costs provide a significant advantage for miners, allowing them to achieve the 10% ROI more easily.

- Bitcoin Price Fluctuations: A sustained increase in Bitcoin’s price can boost profitability, while a decrease can make it harder to reach the 10% mark.

Strategies for Achieving the 10% Rule

- Optimizing Hardware: Choosing energy-efficient mining hardware and optimizing its performance can significantly reduce operating costs.

- Location Selection: Locating mining operations in regions with low energy costs can make a substantial difference in profitability.

- Diversification: Investing in multiple mining pools or diversifying into other cryptocurrencies can mitigate risks associated with Bitcoin price fluctuations.

- Cloud Mining: Cloud mining services allow individuals to participate in mining without needing to purchase and maintain their own hardware. However, it’s essential to choose reputable providers with transparent pricing.

- Scaling Operations: As the 10% rule is based on annual ROI, increasing mining capacity can potentially lead to higher profits. However, this requires careful planning and investment.

Beyond the 10% Rule: The Importance of Flexibility

While the 10% rule provides a useful benchmark, it’s important to remember that it’s just a guideline. Factors like market conditions and individual risk tolerance can influence a miner’s profitability goals.

- Short-Term vs. Long-Term: Some miners might be willing to accept lower returns in the short term, hoping for a long-term increase in Bitcoin’s price. Others might prioritize immediate profitability and adjust their strategies accordingly.

- Risk Tolerance: High-risk miners might be willing to invest in more expensive, high-performance hardware, hoping for substantial returns. Lower-risk miners might opt for more conservative approaches, focusing on minimizing costs and maximizing efficiency.

The Future of Bitcoin Mining Profitability

The future of Bitcoin mining profitability is uncertain, influenced by various factors like regulatory changes, technological advancements, and market sentiment. However, the 10% rule provides a valuable framework for navigating these uncertainties.

- Technological Advancements: Continued advancements in mining hardware and energy efficiency could lead to increased profitability for miners.

- Regulation: Governments around the world are exploring regulations for cryptocurrency mining, which could impact its profitability.

- Competition: The increasing number of miners entering the market can lead to higher network difficulty, making it harder to earn rewards.

Conclusion

Bitcoin mining profitability is a dynamic and challenging landscape. The 10% rule offers a crucial guideline for miners, helping them assess their operations and make informed decisions. By optimizing hardware, choosing strategic locations, and adapting to market conditions, miners can increase their chances of achieving sustainable profitability. While the future of Bitcoin mining remains uncertain, a focus on efficiency, diversification, and adaptability will be key to navigating the ever-changing world of cryptocurrency mining.

Closure

Thus, we hope this article has provided valuable insights into Crushing Bitcoin Mining Profitability: The 10% Rule and How to Stay Ahead. We thank you for taking the time to read this article. See you in our next article!

google.com