The 5X Risk: Unmasking the Dangerous Power of Crypto Leverage Trading

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The 5X Risk: Unmasking the Dangerous Power of Crypto Leverage Trading. Let’s weave interesting information and offer fresh perspectives to the readers.

The 5X Risk: Unmasking the Dangerous Power of Crypto Leverage Trading

Cryptocurrency trading, already known for its volatility, has taken a dangerous turn with the rise of leverage trading. This practice, which allows traders to amplify their potential profits by borrowing funds, has become increasingly popular, promising explosive gains. But beneath the alluring facade of quick riches lies a treacherous path fraught with devastating consequences.

The Allure of Leverage:

Leverage trading, in its simplest form, allows traders to control a larger position in a cryptocurrency than their initial investment would normally allow. For example, a 5x leverage allows a trader to control $5 worth of Bitcoin with just $1 of their own capital. This magnification can lead to substantial profits if the market moves in the trader’s favor.

Imagine: You invest $100 in Bitcoin at $20,000. If the price rises to $21,000, you’d make a 5% profit, earning $5. But with 5x leverage, you’re essentially controlling $500 worth of Bitcoin. The same 5% price increase would now yield a profit of $25. The potential for rapid gains is undeniably appealing.

The Dark Side of Leverage:

However, the same leverage that amplifies profits also magnifies losses. If the market moves against the trader, the borrowed funds amplify the losses, potentially leading to a situation known as margin call. This occurs when the losses exceed the initial investment, forcing the trader to deposit more funds to maintain their position. If they fail to do so, their position is liquidated, and they can lose their entire investment.

A 5x leverage, while potentially offering 5x the profit, also exposes the trader to 5x the risk. This means that a 20% drop in the market can wipe out their entire investment.

The Pitfalls of Leverage Trading:

Increased Risk: Leverage trading inherently increases the risk of losing money. Even small market fluctuations can lead to significant losses, especially when using high leverage ratios.

-

Margin Calls: As mentioned earlier, margin calls can be a major problem. They can happen unexpectedly, leaving traders scrambling to replenish their accounts or face liquidation.

-

Liquidation: Liquidation occurs when the losses exceed the trader’s initial investment, and the exchange automatically closes the position. This can result in substantial losses and even negative balances.

-

Emotional Trading: The potential for quick profits can trigger emotional trading, leading to impulsive decisions and poor risk management.

-

Lack of Experience: Many novice traders jump into leverage trading without proper understanding of its risks and complexities, leading to disastrous consequences.

The Dangers of Leverage Trading in Crypto:

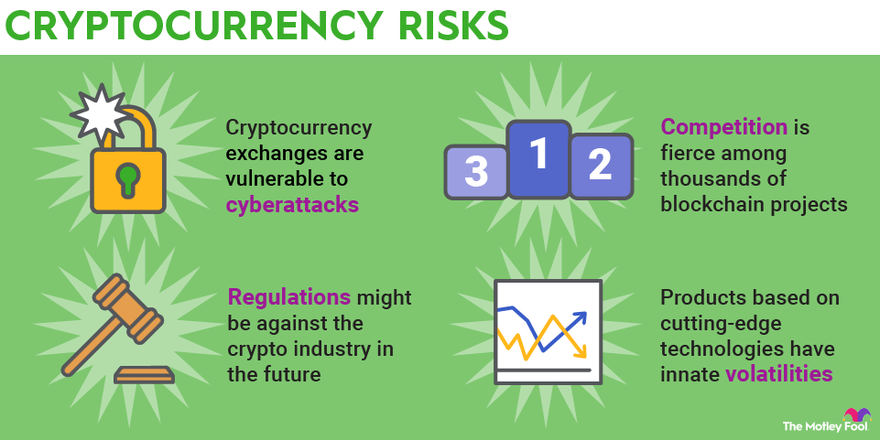

Cryptocurrency markets are inherently volatile, making leverage trading even riskier. The rapid price fluctuations and unpredictable nature of the market amplify the potential for losses.

Furthermore, the lack of regulation in the crypto space can exacerbate these risks. Unlike traditional financial markets, crypto exchanges are not subject to the same level of oversight, leaving traders vulnerable to scams, hacks, and other unforeseen events.

Responsible Leverage Trading:

While leverage trading can be a powerful tool for experienced traders, it should be approached with extreme caution.

-

Thorough Understanding: It is crucial to fully understand the risks involved and how leverage works before engaging in any leverage trading.

-

Risk Management: Implementing strict risk management strategies is essential. This includes setting stop-loss orders to limit potential losses and only using a small portion of your capital for leverage trading.

-

Proper Research: Conduct thorough research on the cryptocurrencies you’re trading and the exchanges you’re using.

-

Start Small: Begin with small leverage ratios and gradually increase them as you gain experience and confidence.

-

Diversification: Diversify your portfolio across multiple cryptocurrencies and trading strategies to mitigate risk.

The Bottom Line:

Leverage trading in the crypto market can be a double-edged sword. While it offers the potential for substantial profits, it also carries a tremendous risk of significant losses.

For the vast majority of traders, especially those new to the market, leverage trading is best avoided. The risks far outweigh the potential rewards, and the consequences of a single wrong move can be devastating.

Instead of chasing quick gains, focus on building a solid foundation of knowledge, developing sound risk management strategies, and understanding the intricacies of the crypto market. Only then can you navigate the treacherous waters of leverage trading with a greater chance of success.

Closure

Thus, we hope this article has provided valuable insights into The 5X Risk: Unmasking the Dangerous Power of Crypto Leverage Trading. We appreciate your attention to our article. See you in our next article!

google.com